2024 Pay Period Calendar Calculator

2024 Pay Period Calendar Calculator – How Is Your Paycheck’s Income Tax Withholding Calculated? When you start a new job, you’re required to complete an IRS Form W-4, which is used to determine how much federal income tax and . However, payroll paid and calculate the gross retroactive pay amount. Because retroactive payments go on the employee’s next paycheck, remember to add the amount owed in retro pay to the amount .

2024 Pay Period Calendar Calculator

Source : www.hourly.io2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.com2023 and 2024 Semimonthly Pay Schedules Hourly, Inc.

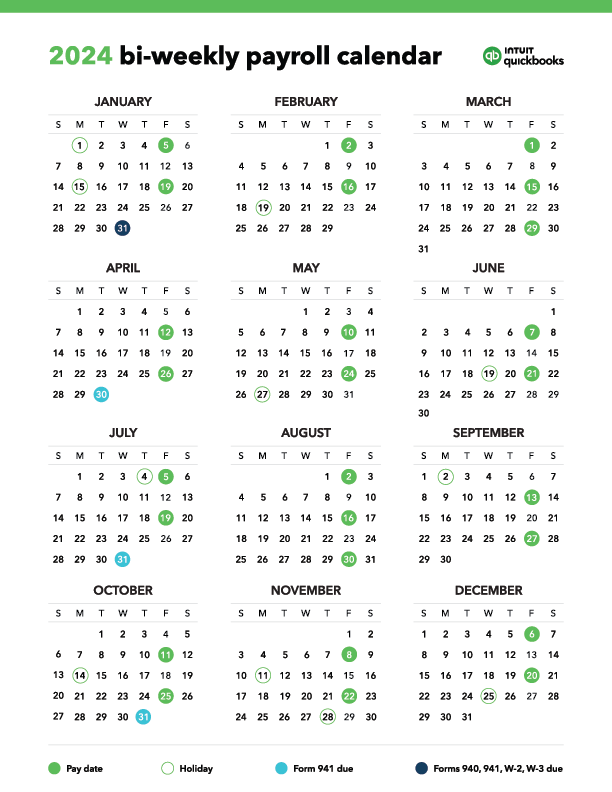

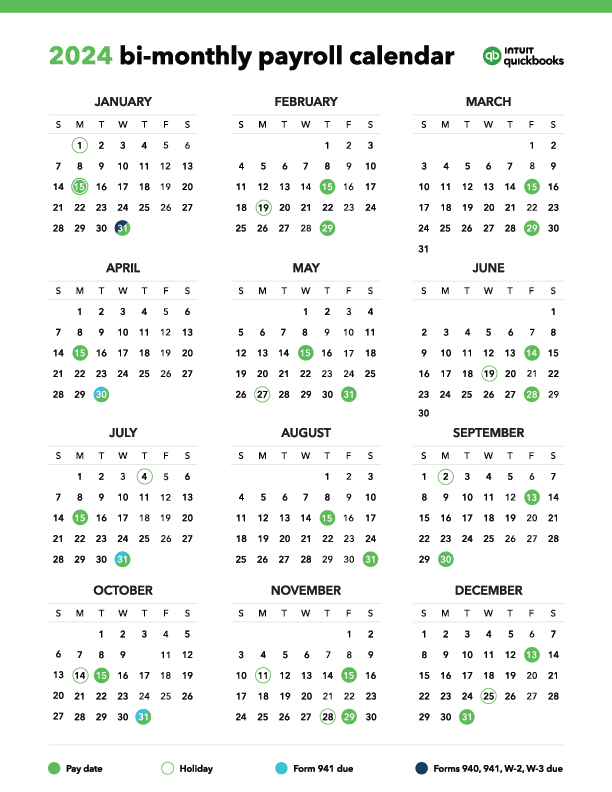

Source : www.hourly.ioPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.comPayroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com2024 Payroll Calendar: Weekly, Monthly, & More – Forbes Advisor

Source : www.forbes.com2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.

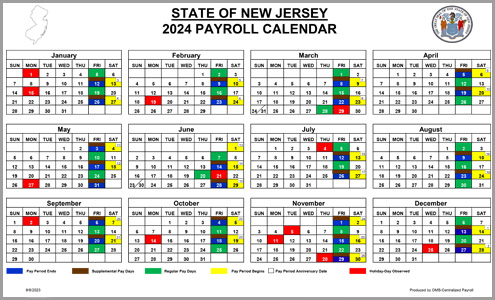

Source : www.hourly.ioNJ OMB Centralized Payroll

Source : www.nj.govBiweekly 2024 Payroll Calendar

Source : www.dartmouth.edu2024 Pay Period Calendar Calculator 2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.: Most companies choose either a biweekly or semimonthly pay period, depending on how they want to approach their yearly schedules. However, some states require hourly workers to be paid weekly. Step 4: . Please refer to the Management Tools for instructions for managing hourly employee payroll. Federal income tax is calculated based on IRS tax tables and selections made on Form W-4. State and local .

]]>